Overview

FlavorCloud provides international shipping and return services door to door worldwide including guaranteed landed costs inclusive of all duties and taxes. Connecting your ShipperHQ account to FlavorCloud allows you to offer FlavorCloud’s competitive international shipping rates to customers and ensure no surprises for delivery. When you’re ready to ship, FlavorCloud’s dashboard allows you to print and process orders and generate all customs paperwork and commercial invoices required.

Learn more about FlavorCloud on the ShipperHQ Marketplace.

This document will cover how to add FlavorCloud to your ShipperHQ account. You will create a FlavorCloud “App ID” and “API Key”. The instructions below will tell you where to go and how to get them.

Requirements

Follow these directions to obtain or create the necessary credentials and add the FlavorCloud carrier in ShipperHQ.

Register for FlavorCloud Credentials

- If you do not yet have a FlavorCloud account, you’ll need to sign up for an account at FlavorCloud.com. If you already have an account, contact FlavorCloud to obtain your API credentials.

- You should receive an “App ID” and “API Key” which will be used to install FlavorCloud on your ShipperHQ account.

Update Product Classification and HS Codes

In order to receive accurate duties & tax calculation for a fully landed cost, you will need to ensure all SKUs you intend to ship internationally in your eCommerce platform’s product catalog have been updated with 6-digit HS Codes (Harmonized System codes of the Harmonized Tariff Schedule or HST used to classify imports and exports). FlavorCloud offers classification services to help you ensure your catalog is properly classified, contact them directly for more information.

Once you have your product HS Codes, you’ll need to update your products with these codes to ensure ShipperHQ can retrieve them when generating shipping rates.

HS Codes in Magento 1, Magento 2, or WooCommerce

When the ShipperHQ extension is installed, it adds a new HS Code product attribute. If this attribute is not available, ensure you’re running the latest version of the ShipperHQ extension.

More about ShipperHQ Attributes for Magento

More about ShipperHQ Attributes for WooCommerce

HS Codes in Shopify

HS Codes can be set on products or product variants using the “Edit Shipping Properties” option when editing a product within Shopify or via any other Metafields editor. Learn More

HS Codes in BigCommerce

HS Codes can be set as values of the Shipping Group field on products and product options in BigCommerce by prefixing the HS Code with “^HS:”. For example, “^HS:03.07.40” for HS Code 03.07.40. Learn More

DDU vs. DDP

Delivered Duty Unpaid (DDU) indicates that the seller is responsible for all associated costs of transport, but when a product arrives at the destination the buyer becomes responsible for paying import duties and taxes. In ShipperHQ, If customers are using DDP then they MUST have hs-codes on their products.

Delivered Duties Paid (DDP) indicates that the seller pays for all duties, import clearance, and taxes. In ShipperHQ If they are using DDU then hs codes are not required.

Steps To Add the FlavorCloud Carrier

- Go to the Marketplace in the ShipperHQ dashboard

- Use the search feature to locate FlavorCloud

- Select Install

- Follow the prompts to validate your account using the FlavorCloud API credentials provided by FlavorCloud.

- Success! FlavorCloud has now been added to your list of carriers in ShipperHQ.

Steps to Validate This Carrier

In order for your live rate carrier to access your live rates, you will need to enter your carrier account credentials for FlavorCloud and have them validated.

Validation, simply means that ShipperHQ was able to access the shipping account related to the credentials that you entered and retrieve rates.

If you choose to skip validation after adding your new carrier you will be reminded to add your credentials later.

To Validate your FlavorCloud account:

- Select Enter Credentials & Validate

- Review the information required to validate, which is:

- A registered account

- Your App ID

- API Key

- Once you have these credentials, Continue

- Enter the App ID and API Key provided to you by FlavorCloud and ensure the Unit of Weight and Unit of Measure are correct for your site then click Continue when complete

Note: Successful installation depends on the accurate entry of the account information required by each carrier. If you do not have the correct information you will not be able to validate your carrier and receive live rates.

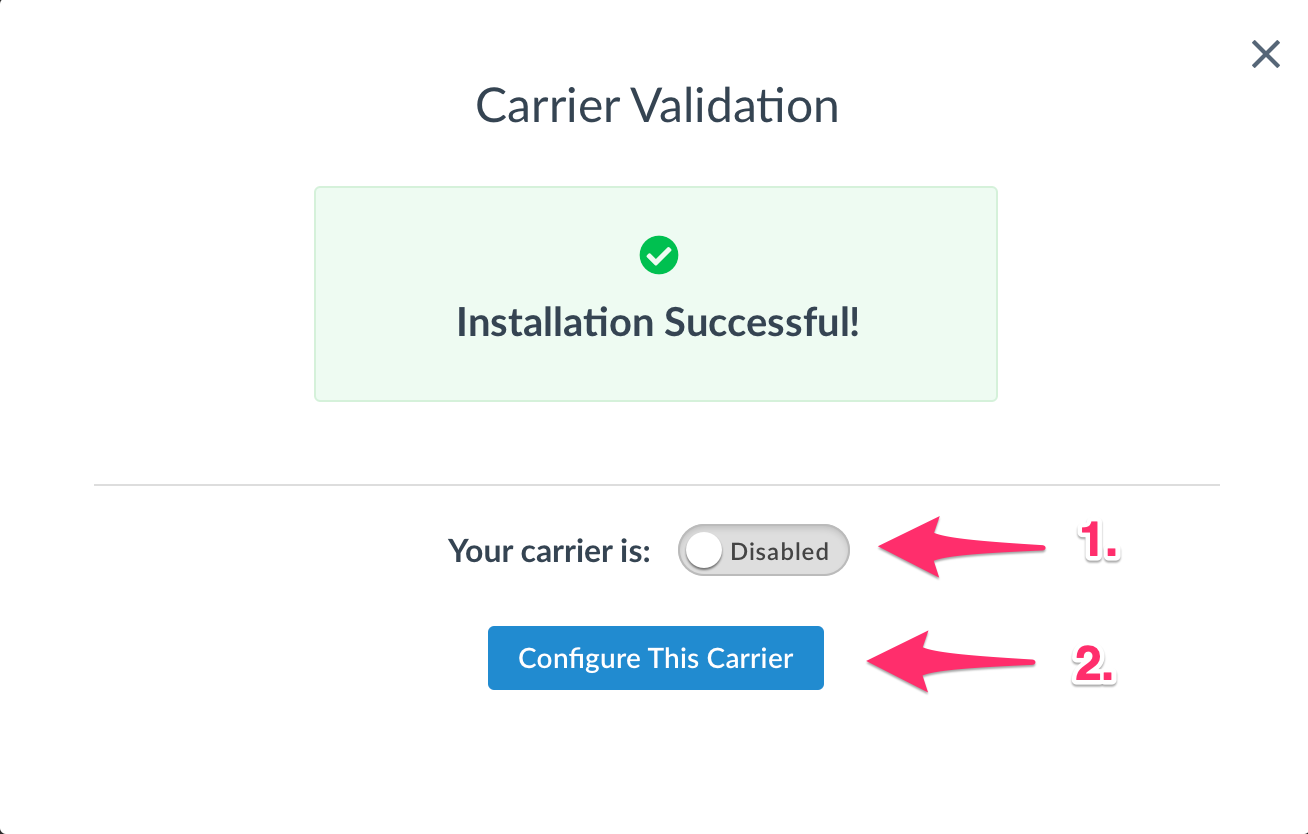

- If validation is successful, you will be presented with:

- The option to enable your carrier right away. (Enabling your carrier at this time will turn its rates on immediately even before you have made any configuration adjustments to it.)

- Begin to configure. Continuing with this button will take you to the carrier’s configuration page. You can also enable the carrier from this page once you have saved your settings.

Troubleshooting

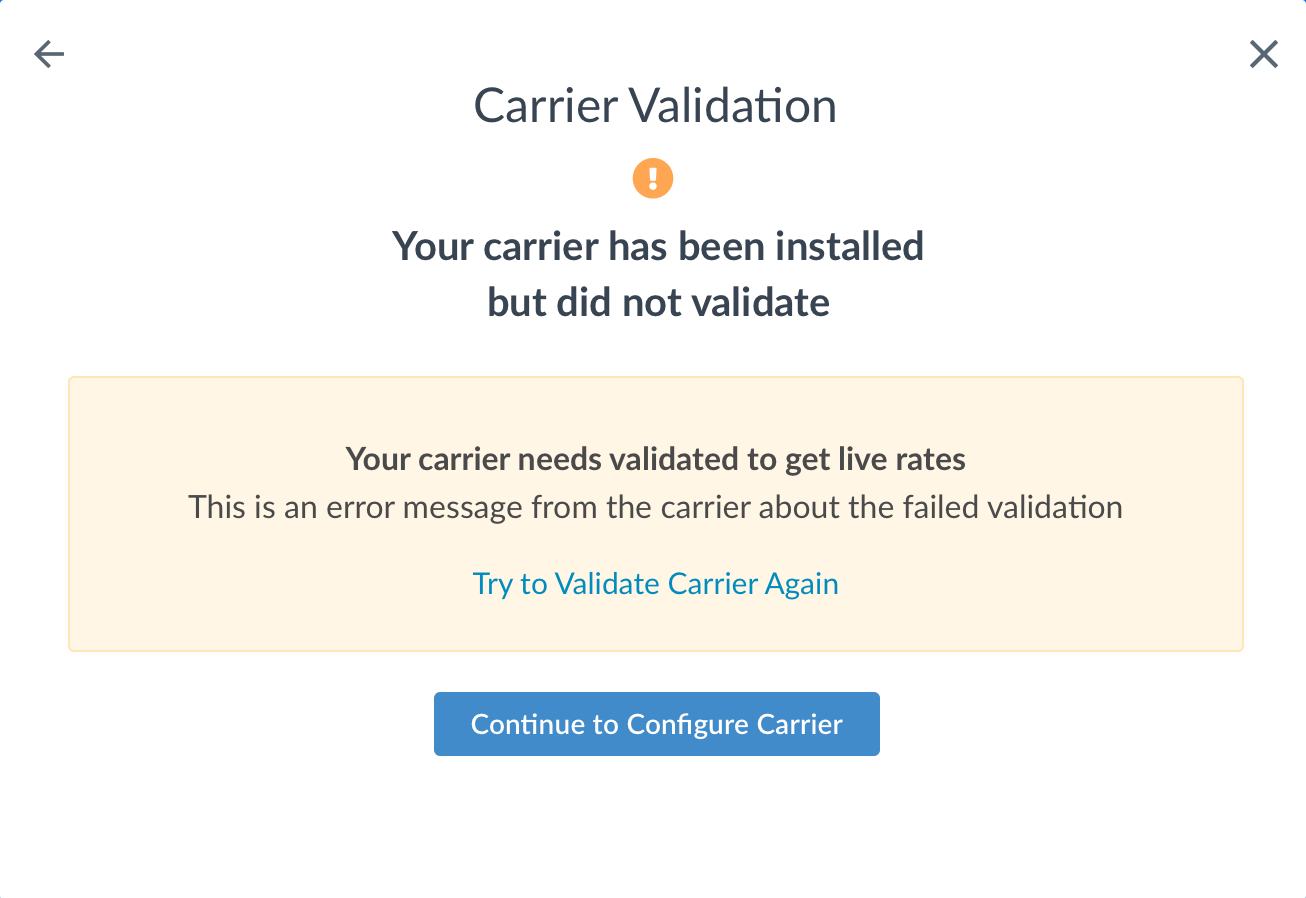

Installed but not validated

Your carrier can be installed and configured, but not validated. Successful validation depends on the accurate entry of the account information required by each carrier. If you do not have the correct information you will not be able to validate your carrier and receive live rates.